PARCEL LOCKERS

Key Questions Answered

Last-mile cost pressures incentivise out-of-home delivery

Last-mile delivery is the most expensive and complex part of a delivery journey, representing ~50% of the total cost of a parcel delivery according to Accenture1. B2C parcel volumes have risen massively in the last several years, accelerated by

the pandemic, and the long-term trend is for continued growth. The World Economic Forum expects demand for last-mile delivery to grow a further 78% by 20302.

Home deliveries contribute significantly to last-mile costs, as delivery drivers take much longer to deliver packages to hundreds of addresses than if they were to deliver in bulk to out-of-home (OOH) locations, such as parcel lockers. The extra time taken and additional miles driven for home deliveries result in higher emissions, higher fuel costs and higher labour costs per parcel.

To continue to meet the anticipated demand for their services over the next few years, we believe that it is a logical conclusion that carriers will need to utilise out-of-home delivery networks to improve their unit economics by consolidating deliveries, reducing the number of failed deliveries and making their existing operating capacity more efficient.

From a consumer perspective, we believe OOH networks will increasingly be accepted as offering increased flexibility and convenience, which will have a corollary effect on their perception by posts and carriers. Our Post-Covid report showed that 58% of consumers were spending less time at home than they had been before the pandemic, and that flexibility was an important factor to 79% of shoppers when it comes to delivery3.

Mike Hancox, chief executive of UK carrier Yodel, believes that over time “people will be less obsessed with delivery to home.”

Mike Hancox, chief executive of UK carrier Yodel, believes that over time “people will be less obsessed with delivery to home.” In 2023, Yodel has seen out-of-home deliveries increase well above the rate of overall ecommerce volume, forecasting 40 million packages delivered to out-of-home locations in 2023 versus just 25 million in 2022, a 60% increase4.

Why lockers?

Lockers are automated and offer security, simplicity, convenience, and an automated experience for consumers. They have the same consolidation benefits as other out-of-home delivery options, but cater to consumers who want to pick up parcels at hours when a PUDO location might not be open, those who would prefer not to speak to a person to collect their parcel, and those who don’t want to queue in a post office or PUDO location.

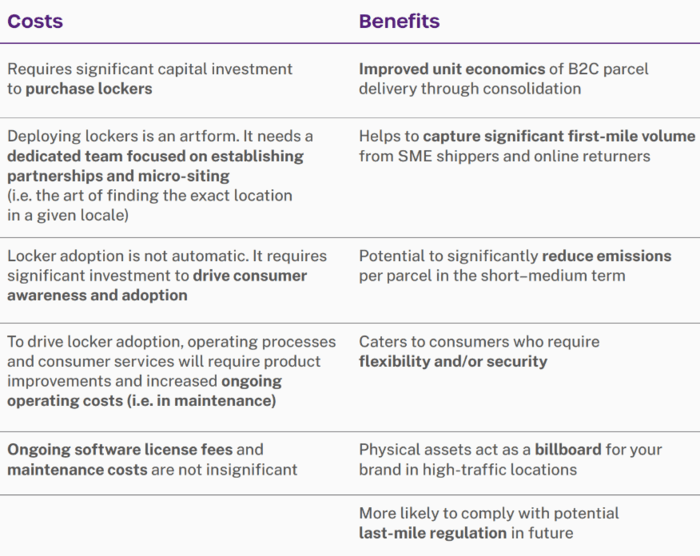

COSTS & BENEFITS OF PARCEL LOCKERS

Doddle’s own 202110 research showed that 34% of the 18–24 age bracket preferred lockers as their out-of-home delivery method of choice, compared to 24% of the general population.

China is the nation with the most lockers, and where the most volume goes through parcel lockers

China is the nation with the most lockers, and where the most volume goes through parcel lockers, but this is often due to the courier deciding to use the locker rather than deliver to home, even when consumers selected home delivery at the checkout.

Poland is also a major leader in lockers, where InPost’s primarily locker-based delivery network delivers 43% of parcels. The national post is also investing, putting an estimated 4,000 Swipbox lockers into market by the end of 2023. These lockers will be used by DHL and DPD as well as Poczta Polska for last-mile delivery.

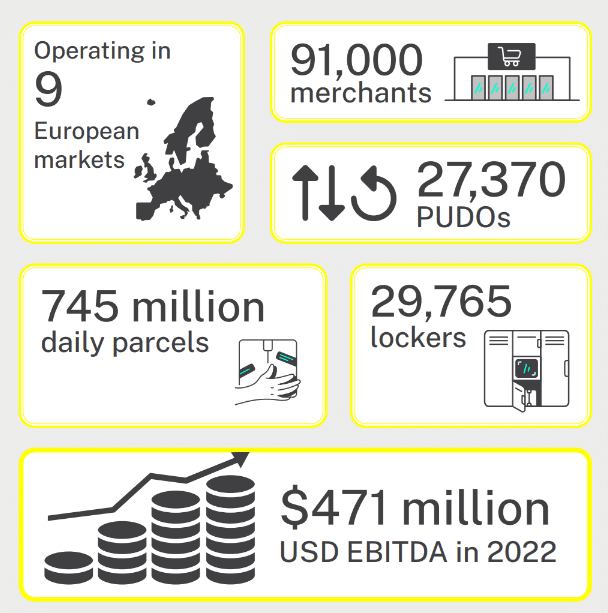

EUROPEAN CASE STUDY: INPOST

InPost has become the European poster child for parcel lockers thanks to its widespread network, huge success in native Poland and continued expansion across the continent. In 2021 it acquired French PUDO business Mondial Relay, giving it access to nearly 12,000 PUDO locations across the country, which it is now supplementing with its lockers.

InPost has approximately a 50:50 split of lockers and PUDO locations

After a huge IPO in 2021, InPost is a seriously profitable business, generating nearly half a billion USD in EBITDA in 2022.

Notably, it’s not an agnostic solution, and where Hive Box processes ~5% of Chinese parcel volume, InPost has 43% of the Polish market. Together with the fact that InPost’s end users are affirmatively choosing to use lockers rather than the courier making the choice, these stats might go some way to explaining the delta in profitability between the two businesses.

InPost has added something like 4,000 lockers to its UK network in the last 3 years, as well as 3,000 in France since 2021. Acquiring Mondial Relay also gave it a PUDO footprint in Iberia. Surprisingly, for a business so heavily associated with lockers, InPost actually has an almost 50:50 split of out-of-home delivery formats.

Indeed, it appears to be extending its UK network through PUDO, as its latest reporting shows a small number of PUDO locations in the market for the first time.

That put Hive Box’s market share up to 65%. In January 2021, Hive Box completed another round of financing, worth $400 million USD. Today Hive Box is by some distance the biggest parcel locker operator in the world.

the Polish market is where 59% of group revenue originated in 2022.

But it’s in Poland where InPost has been by far the most successful, and the Polish market is where 59% of group revenue originated in 2022. It has over 20,000 APMs in the country, with 17 million users, of which 20% receive or send more than 40 parcels per year. 95% of its parcels are delivered next-day, 59% of the country lives within a 7-minute walk from an APM, and collections take around 7 seconds, per the business. Importantly, APM deliveries are also 20–25% cheaper for merchants, according to InPost — a significant factor in their uptake among retailers.

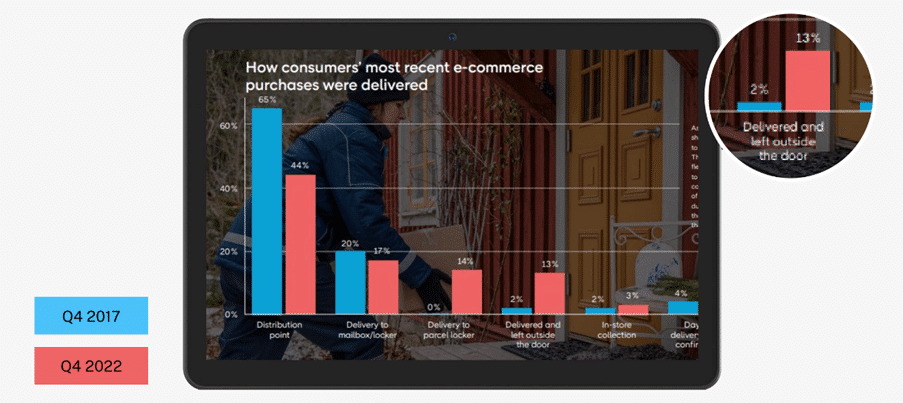

Home delivery efficiency is increasing as unattended deliveries become more common. This chart from Post Nord shows how deliveries left outside the doorstep have jumped by 11 percentage points in the 5 years from 2017 to 2022.

Arguably this reduces the need for out-of-home deliveries, as unattended delivery takes less time and does not require redelivery attempts. There’s less concern about theft or damage in low-risk areas or with designated parcel boxes at homes.

However, in that same period parcel locker usage has also begun and is more common than unattended delivery. For the carrier, it simply makes more sense to consolidate deliveries, and parcel lockers are explicitly designed to safely store and enable the collection of parcels, whereas consumers may not have safe places for parcels to be left, or simply prefer to know exactly where it will be.

While first-time delivery rates might be increasing, the fact that as many as 10% of deliveries still fail, first time remains hugely expensive for carriers and impactful for consumers, reducing their satisfaction and damaging their relationship with the merchant as well as the carrier. For that reason alone both PUDOs and parcel lockers have a role to play in a) alleviating this worst-case scenario by offering a local, convenient redirect point after a failed delivery and b) eliminating the possibility in the first place when consumers select out-of-home delivery.

Stay in the loop with Leaders in Logistics

Subscribe to our newsletter to receive news,

updates and special offers.